Calculation of Annual OPEB Cost

Attachment C to letter of New Financial Reporting Requirements for Postemployment Benefits Other Than Pensions (OPEB) dated February 26, 2007.The following illustration describes the calculation of annual OPEB cost where an local educational agency (LEA) has not fully contributed its annual required contribution (ARC) or has recognized a liability at transition. Definitions of the terms and acronyms used in this illustration are provided in Attachment A.

Annual OPEB cost is the accrual-basis measure of an employer’s periodic cost of offering OPEB. It is the cost that is recognized in accrual-basis financial statements, regardless of amounts actually funded.

Normally the ARC serves as the measure of annual OPEB cost. However, where an employer contributes less than the ARC, a net OPEB obligation is created. When this occurs, the ARCs calculated in subsequent valuations must include an amount for amortization of the past contribution deficiency. The calculation of annual OPEB cost becomes more complicated because the ARC must be adjusted in two ways before it can serve as a measure of OPEB cost:

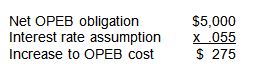

- OPEB cost must be increased to reflect lost interest earnings on amounts not contributed, and

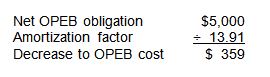

- OPEB cost must be decreased by the amount included in any subsequent calculation of the ARC to recapture, or amortize, the prior contribution deficiency. Note that this adjustment only becomes necessary once a subsequent valuation is performed.

If these adjustments were not made, annual OPEB cost and the net OPEB obligation would be overstated by the amounts that were previously recognized in annual OPEB cost.

For example:

ARC Year 1 = $7,000

ARC Year 2 = $7,500

ARC Year 3 = $7,859

The employer fully contributes its ARC in year 1. There is no net OPEB obligation and the ARC in Year 2 ($7,500) is the measure of OPEB cost in Year 2. However, in Year 2 the employer contributes only $2,500, creating a net OPEB obligation of $5,000.

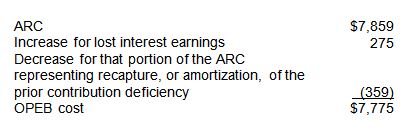

Prior to the creation of the net OPEB obligation, the ARC for Year 3 ($7,859) would have served as the measure of OPEB cost, but the existence of the net OPEB obligation necessitates two adjustments.

-

OPEB cost must be increased for the lost interest earnings on the amount not contributed:

- Once a subsequent valuation is performed, OPEB cost must be decreased for the amount included in the subsequent calculation of the ARC for recapture of the prior contribution deficiency. The amortization factor used by the actuary to calculate the subsequent ARC (13.91 in this example) is used for this adjustment.

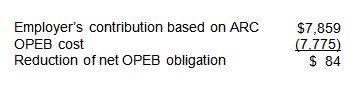

OPEB cost thus differs from the ARC:

These adjustments prevent accrual-basis OPEB costs that were recognized previously from being recognized again.

Fully funding the ARC in subsequent years would systematically eliminate the net OPEB obligation: