Attributing OPEB contributions to the ARC

Attachment D to letter of New Financial Reporting Requirements for Postemployment Benefits Other Than Pensions (OPEB) dated February 26, 2007.Where a local educational agency’s (LEA’s) OPEB contributions are exactly equal to the annual required contribution (ARC), the components of the ARC to which the contribution applies are as provided in the valuation report. However, where an LEA’s OPEB contributions are more than or less than the ARC, the amounts contributed must be attributed to the components of the ARC in the following manner. Definitions of the terms and acronyms used in this document are provided in Attachment A.

Contributions less than the ARC: Where the LEA contributes less than the ARC, the amounts contributed must be attributed proportionally to the components of the ARC. For example, if the Normal cost component as shown in the actuarial valuation is 45% of the ARC and the amortization of the unfunded actuarial accrued liability (UAAL) component is 55% of the ARC, 45% of the LEA’s contribution is assumed to apply to the Normal costs and 55% is assumed to apply to amortization.

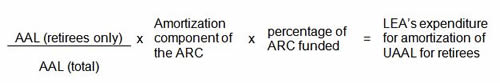

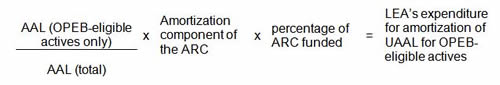

Attributing the LEA’s contributions for amortization of the UAAL between retirees and active employees would require an assumption about the attribution of plan assets between retirees and active employees, for which there is no actuarial protocol. However, for purposes of charging OPEB to programs, LEAs should attribute their contributions for amortization of the UAAL between retirees and active employees using the ratio of the actuarial accrued liability (AAL) for retirees to the AAL for active employees. For example:

Contributions greater than the ARC: Where the LEA contributes more than the ARC, the amounts contributed in excess of the Normal Cost apply to the UAAL. The contribution for amortization of the UAAL is attributed between retirees and active employees using the ratio of the AAL for retirees to the AAL for active plan members, as described above.